Business Analysis Services

OpenTRM provides a Business Analysis Services to support Digital and AI Transformation of financial organisations.

Business analysis is the basis for smart IT design, planning and business-IT alignment. Lacking an understanding of the business need, it is virtually impossible to craft a suitable IT solution or business process.

Our team of business analysts can articulate your requirements in a variety of contexts including a request for proposal (RFP), an in-house software development (BRD, FSD, TSD), a business processes re-engineering project, or a broader effort to align project scopes with the business’s objectives.

How can OpenTRM help?

OpenTRM can help you to understand your requirements better to make effective and cost-efficient business aligned technology and process changes. The team at OpenTRM can help with:

RFP development, management and evaluation support:

– We can provide support through the entire procurement lifecycle. We can accelerate your procurement by developing the business requirements and RFP requirements at the same time. Moreover, powered by proven methods, tools, and techniques, our Business Analysts can help you set up a fair, and transparent vendor evaluation process.

Managing requirements throughout the systems development lifecycle:

– We help you to implement the governance, processes and tools required to manage requirements for a systems development and implementation including successfully initial requirements capture, requirements change management and traceability to testing and delivered functionality.

Business process modelling:

– Our skilled business process modelling consultants can facilitate the timely and accurate capture of your current and future essential business processes in the context of a business process automation, or business process re-engineering project using industry process modelling languages/standards such as BPMN or UML.

Project business alignment and scope review:

– With an understanding of your requirements, we can help you to understand how a project aligns with your overall business objectives and what capabilities are mandatory or optional to accomplish your goals.

– We can help you better understand and capture the needs of your stakeholders to support system selection, business case development, business decisions and IT strategy development.

We provide consulting services in the field of audit, optimization, analysis and automation of business processes of financial organizations, including for departments of the Treasury, Trade Department, Investment Department, Risk Department, Finance Department, Credit Department, Information Technology Department.

For Front office: General audit of current business processes, collection and analysis of business requirements, preparation of recommendations in the field of automating the maintenance of positions of financial assets (FX / MM, Capital Markets, ex-traded and OTC Derivatives), search and saving of concluded transactions and calculation of financial results .

For Middle office: General audit of current business processes, collection and analysis of business requirements, preparation of recommendations for automation in the preparation of Consolidated Management Reporting; Regulatory reporting (Central Bank of the Russian Federation); managing credit, settlement and market risk limits; liquidity management and collateral management of a financial institution.

For Risk Management: General audit of current business processes, collection and analysis of business requirements, preparation of recommendations for automation in the field of calculation methodology, control of credit, market, settlement and operational risks.

Also Analysis and processing of big data (Big Data): Analysis and formation of a turnkey solution for the rapid extraction, processing and comprehensive analysis of information based on modern statistical analysis systems and data capture and processing systems: Cloudera, EMC, Oracle, IBM, Informatica, QlikView, Teradata, open source software. Cloudera, EMC, Oracle, IBM, Informatica, QlikView, Teradata, open source software.

Our key competitive advantage in solving any problem is our team of professionals with unique long-term experience, both on the side of the leading international providers of software and hardware solutions, and on the side of the largest financial institutions in the field:

- Risk management;

- Financial management and planning;

- Asset and liability management;

- Trading operations in financial markets;

- Information technologies.

Many years of experience in these segments has allowed us to form a database of contacts of highly qualified professionals with an impeccable reputation. Therefore, we practice a flexible and adaptive approach in the formation of a project team, combining the use of highly qualified specialists of the company with well-known experts in the market who can be involved in solving key tasks. At the same time, the execution of all projects is carried out using advanced methodologies such as Scrum and Agile.

This approach allows us to offer our clients a competitive professional service that reduces costs while maintaining the quality of task performance.

Implementation and support

We offer our clients a full range of services for the analysis, development, implementation, support, automation of business processes related to the implementation of financial transactions affecting the specialized divisions of the front, middle office, treasury and risks, both on the basis of software and hardware systems from global suppliers , such as Wolters Kluwer, Finastra and Murex, as well as on its own Open Neurons ETL platform, allowing financial institutions to receive not only methodological, but also information technology support.

We are the only official partner and distributor of Wolters Kluwer Financial Service in Russia, the world leader in financial software for treasury and risk, which allows us to offer our clients unique, profitable solutions with a comfortable pricing policy.

We provide technological services to financial institutions and corporate companies in the field of implementation, refinement (customization) and / or support of IT systems for:

- Accounting for financial transactions;

- Investment management;

- Financial risk management.

The service may include:

- Collection and analysis of customer requirements for the IT system

- Customization of the system according to the requirements of the customer

- Integration of the system with the necessary data sources

- Conduct user testing and trial operation of the system (UAT)

- Documentation and general management of the IT systems implementation project

- Follow-up support of IT systems

Our team has practical expertise and offers services for customization, integration or turnkey implementation of solutions based on the platforms of international financial software providers:

- Finastra (Kondor Fusion Risk) https://www.finastra.com/solutions/finastra-kondor

- Wolters Kluwer Financial Systems (WKFS One SumX) https://www.wolterskluwer.com/en/finance

- Prometeia ERMAS https://www.prometeia.com/en/tech-solutions

- FIS (Front Arena) https://www.fisglobal.com/en/products/fis-cross-asset-trading-and-risk-platform

- Murex (MX.3) https://www.murex.com/en/solutions/mx3-leading-integrated-capital-markets-solution

- Adenza (ex. Calypso) https://adenza.com/solutions/adenza-capital-market-solutions/

- EGAR Technology https://egartech.ru/risks

- Systematica Business Software http://www.systematica.ru/products/

Additionally, we can offer training (training) programs for the customer’s employees to work with the above software.

To solve the problems of implementing financial software, the OpenTRM team has expert skills in the field of DBMS design (Oracle, MS SQL, Sybase, PostgreSQL, Greenplam); development of Python, Java, C/C++; Windows/Unix/Ubuntu administration; configuration and deployment of solution components in the cloud infrastructure of Amazon AWS/MS Azure/Yandex Cloud

Our team has over 50 successful projects completed for large financial companies and banks, including: Rosselkhozbank, Absolut Bank, Rosbank, Alfa Bank, Bank St. Petersburg, Sobinbank, VTB Bank, Bank Soyuz, Bank Trust, Akbars Bank, UkrExim Bank, Unicredit Bank, Intesa Bank;

Integration

Carrying out work on integration, information enrichment of systems for the Treasury, Risk Management, Trading, Lending, including further support and development, based on the Open Neurons ETL platform of our own design

OpenNeurons.ETL is a flexible, powerful, modern tool for rapid integration of heterogeneous systems. Using ready-made interaction modules, an open architecture, and the ability to write their own business logic and adapters for new systems in the high-level Python language, OpenNeurons.ETL users can solve the integration tasks set either independently or with the involvement of OpenTRM specialized specialists.

The OpenNeurons.ETL distribution package already includes more than 60 ready-made adapters for widely used both external and internal systems of organizations, including MS Office, DBMS, XML, RU Data services, Bloomberg, Murex, the Central Bank of the Russian Federation, Wolters Kluwer. Thus, a complex integration task can be significantly simplified if you use a ready-made solution.

The OpenNeurons.ETL platform already includes a storage layer, so the customer does not need to deploy a separate storage.

Using OpenNeurons.ETL, the user has access to ready-made standard integration schemes, mechanisms for initiating data loading based on a schedule or event, comprehensive control over the execution of the process, and timely notification of errors and collisions.

OpenNeurons.ETL can be installed both in the cloud and on the customer’s internal infrastructure. In the latter case, additionally guaranteeing the safety of data in the customer’s internal perimeter.

You can purchase OpenNeurons.ETL by contacting our company at the numbers listed below, or by sending an e-mail.

Depending on your needs, you can purchase a permanent OpenNeurons.ETL license. or order a subscription for the period you need

Business Processes Automating

We successfully solve the tasks of automating business processes, collecting and transforming customer data to speed up routine business processes, both in financial institutions and corporations based on the proprietary OpenNeurons.ETL platform.

OpenNeurons.ETL is a flexible, powerful, modern tool for rapid integration of heterogeneous systems. Using ready-made interaction modules, an open architecture and the ability to write your own business logic and adapters for new systems in the high-level Python language, OpenNeurons.ETL users can solve the tasks of automating business processes of any complexity, both independently and with the involvement of specialized specialists OpenTM company.

For example, on the basis of OpenNeurons.ETL, you can easily and efficiently solve tasks related to the preparation of reports, automate work with customer orders, manage the liquidity buffer, combine data from contracts, create a database of suppliers and customers, automate the preparation of a management balance sheet, and conduct portfolio analysis.

You could share with us Functional or Technical specifications or simply describe the tesk that needs to be solved – we will help you collect and formalize functional requirements, draw up a technical task and then turn it into a working solution.

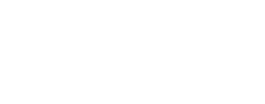

Processing unstructured documents

The innovative module of the OpenNeurons.ETL platform, based on a neural network algorithm, allows you to quickly, accurately and efficiently select a text layer from a scan of even an unstructured document, classify the document and, depending on the class, extract the necessary information.

The system can automatically classify, for example, such commonly used documents:

- Act

- Treaty

- Charter

- Invoice / Invoice advance / Adjustment invoice

- TORG-12

- UPD1

- UPD2

up to 99% accuracy

The system can automatically extract, for example, the following parameters:

- Document date

- Document Number

- Counterparty

- Customer (legal entity customer)

- Contract number

- Agreement date

with an accuracy of up to 90% for each parameter.

also, if it is impossible to extract the parameter, it is possible to send it for manual recognition, no more than 30% for each parameter

Distinctive features of the product are automatic learning to extract information and find patterns for information retrieval. On the part of the customer, there is no need to make any settings to extract information.

Moreover, in the case of a new document structure, when a sufficient number of examples are reached, the system models will automatically adjust to extract parameters from the new document structure, which was previously absent.

Thus, the process of improving models does not stop, and the quality of recognition grows with an increase in the volume of processed documents.

The core of the system can also work with information directories, which greatly improves the quality of information extraction (for example, a list of organizations that the customer works for)

As a response, the set of retrieved parameters and the degree of confidence in the given response are returned.

Preferred implementation architecture: client-server application based on a cloud service.

Finally, product implementation doesn’t end with extracting the parameters from the text layer. It is possible to fully integrate into existing business processes of the customer (or reengineer business processes with the transfer of some of them to the platform), adapt logic or make decisions based on information extracted from the text layer.

RFQ automation

On the basis of the OpenNeurons.ETL platform, which widely uses machine learning algorithms, the tasks of processing incoming client requests are successfully solved, allowing you to extract the necessary information from any message stream coming from various systems, conduct a quote request, prepare a commercial offer and send it to a potential client for seconds

Distinctive features of the product are automatic learning to extract information and find patterns for information retrieval. On the part of the customer, there is no need to make any settings to extract information.

Moreover, if an application of a new format or type appears, upon reaching a sufficient number of examples, the system models will automatically adjust to extract parameters from the new structure of the document, which was previously absent.

Thus, the process of improving models does not stop, and the quality of recognition grows with an increase in the volume of processed documents.

The core of the system can also work with information directories, which greatly improves the quality of information extraction (for example, a list of organizations that the customer works for)

As a response, the set of retrieved parameters and the degree of confidence in the given response are returned.

Preferred implementation architecture: client-server application based on a cloud service.

Product implementation involves not only extracting application parameters from the text layer, but also full integration into the customer’s existing business processes (or reengineering of business processes with transferring some of them to the platform), logic adaptation or decision making based on information extracted from the text layer.

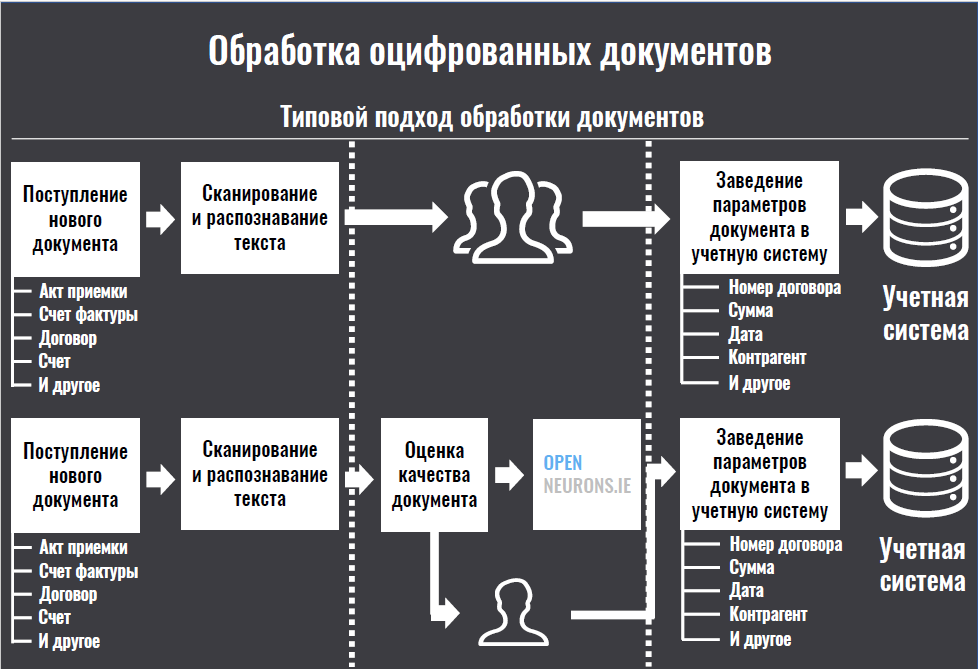

Enriching internal systems with external data

The module for loading external data, based on the high-level Python language, included in the OpenNeurons.ETL distribution, allows you to load any information from external sources into the customer’s internal systems, for example, the results of securities trading, lending market rates, exchange rates, news feed or producer prices and etc.

The Open Neurons package already includes more than 60 ready-made adapters for widely used both external and internal systems of organizations, including MS Office, DBMS, XML, RU Data services, Bloomberg, Murex, the Central Bank of the Russian Federation, Wolters Kluwer.

Allows you to develop your own adapters and data transformation logic in the high-level Python language.

If necessary, for automated launch of processes, you can use the ready-made functionality of the system and execute processes both by event, for example, when certain data appears in an external system, or according to a schedule.

The system can be installed in isolation in the client’s zone, eliminating any risks associated with unauthorized access to system data.

The system works on both Windows and Linux platforms and has an intermediate database for customization and user data storage.

OpenNeurons.ETL + 60 ready-made adapters

Open Neurons – is flexible solution platform for collecting and transforming customer data to reduce routine data processing tasks and use it in business processes of a financial organization or corporation.

The Open Neurons platform already includes more than 60 pre-installed adapters to the most popular data sources for a financial organization and a module for extracting meaningful information from a company’s unstructured data stream, including such as meeting minutes, email, questionnaires, minutes of decisions of collegial management bodies, financial corporate reporting, contracts, loan agreements, prospectuses, primary accounting documents and much more.

Open Neurons allows the Customer to implement full automation of business processes for processing and analyzing unstructured documents of various departments using machine learning algorithms and natural language processing within the agreed time frame.

The service is installed in the customer’s infrastructure or the cloud infrastructure of the OpenTRM company.

The Open Neurons package already includes more than 60 ready-made adapters for widely used both external and internal systems of organizations, including MS Office, DBMS, XML, RU Data services, Bloomberg, Murex, the Central Bank of the Russian Federation, Wolters Kluwer.

Allows you to develop your own adapters and data transformation logic in the high-level Python language.

The system has a simple thin user interface that allows you to control the progress of tasks, the results of process execution, view the results of execution, run tasks in manual mode.

If necessary, for automated launch of processes, you can use the ready-made functionality of the system and execute processes both by event, for example, when certain data appears in an external system, or according to a schedule.

The system can be installed in isolation in the organization’s circuit, eliminating any risks associated with unauthorized access to system data.

The system works on both Windows and Linux platforms and has an intermediate database for customization and user data storage.

The Open Neurons platform also allows you to extract the required data from:

- Decisions of collegiate governing bodies;

- Contracts;

- Issue prospectuses;

- Charters;

- Accounts;

- Invoice account;

- RFQ;

- Letters.

Compiled both in Russian and foreign languages,

Both structured and freeform

Open Neurons successfully copes with such tasks as:

- Organization of a digital platform for the collection, processing and transformation of financial data;

- Automation of business processes in terms of asset-liability management, portfolio analysis, reporting;

- Conducting financial analysis;

- Testing the formulated hypotheses and models on the collected data;

- Conducting backtesting of Models;

- Process automation;

- Processing of unstructured digitized documents, their categorization and extraction of the required information;

You can purchase OpenNeurons.ETL by contacting our company at the numbers listed below, or by sending an e-mail.

Depending on your needs, you can purchase a permanent OpenNeurons.ETL license. or order a subscription for the period you need

Artificial intelligence and machine learning

The OpenNeurons.ETL platform includes advanced technologies in the field of machine learning and artificial intelligence. System owners receive a powerful tool for solving complex, science-intensive tasks, testing various hypotheses, financial, industrial, mathematical modeling, processing, transformation, data enrichment, big data analytics.

Our standard projects

Our standard projects

- Implementation of the Kondor Global Risk system for the bank’s front-middle office;

- Implementation of the Wolters Kluwer system for bank liquidity management;

- Writing a functional, technical specification for business process automation;

- Integration of external and internal customer systems;

- Automation of customer’s business processes;

- Automation of the incoming document flow;

- Automation of work with customer requests;

- Loading data from external sources into the customer’s internal systems;

- Conducting an analysis of the financial and economic activities of the bank;

- Conducting an IT audit.

And many more…